In many different industries, being sure that people are who they say they are is vital to running effective and safe business operations. Whether it’s making a financial transaction, transmitting sensitive information, or performing a background investigation or legal research, verifying that people’s identities should be a top priority. But while this may seem like a straightforward task, the vast amount of information online has made it easier than ever for people to fake identities. And even if people aren’t intentionally faking their identities, it’s still possible to mix a person up with someone else due to mixed up records or a lack of information.

Not verifying that someone is who they claim to be can, at best, lead to wasted time and money, and, at worst, allow for fraud or other criminal activity. To prevent the consequences of mixing up identities and feel certain that you’re dealing with the right people, you can perform identity verification using a public and private records database.

Identity verification (also known as ID verification) is the process of verifying that an individual is who they claim to be using an identity verification service. So what is identity verification service? An identity verification service takes information provided to you, like a name, and matches it against other records, such as address history, property records, multiple credit headers or utility listings data, in order to help you authenticate the identity of an individual.

When performing identity verification, you need to be sure you’re using a service that pulls from multiple data points in order to thoroughly vet individuals. Because people share so much information online, names can get mixed up with the wrong records, meaning it’s important to verify identities using the best identity verification service so you can be sure you’re getting the right records for that specific individual.

Identity verification is key to wellbeing of many different industries. If you’re in any industry in which you need to maintain legal compliance and minimize the risk of fraud, such as in financial services or corporations, you can benefit from online identity verification. Identity verification can also help industries like insurance and healthcare that frequently transmit sensitive information by ensuring that the information is being sent to the right people.

Identity verification also helps investigators, law enforcement, and collections verify the identities of individuals they are investigating or trying to contact to be sure they’re not wasting time pursuing the wrong people. Similarly, legal professionals can perform identity verification to ensure that their client and all involved parties are who they claim to be for quicker and more accurate legal research.

To get started performing online identity verification, you need access to an identity verifier like a public and private records database. A public and private records database provides you with multiple identifiable data points about individuals so you can cross-check the information provided to you with a variety of sources to perform better identity verification. You can even perform a social media search to gather information not easily found in a traditional public records search. And with the right identity verification service, you can access up-to-date information quickly for easier verification and onboarding.

Identity verifications is incredibly useful when performing any investigation. Whether it’s a general business investigation, fraud investigation, or background investigation, you want to be sure you verify the identities of involved parties so that you can gather the right records on the individual and build an accurate and complete profile on those people.

With the right online identity verification service, industries can maintain legal compliance, minimize risk and perform better due diligence. For example, when handling and transmitting sensitive information, whether you’re a legal professional or you work in healthcare, financial services, or insurance, identity verification helps ensure that you’re transmitting the right information to the right people so you don’t end up facing a potential lawsuit. Or, if you work in a corporation or in financial services, you need to verify all the people involved in the business in order to be sure you’re not allowing for any fraud, which can lead to money losses as well as get you into legal trouble if a court determines you acted irresponsibly and didn’t perform proper due diligence.

Identity verification also helps companies uphold a strong reputation by ensuring that everyone involved in your company, including customers, vendors, and third-parties, are who they claim to be. When you integrate identity verification into your business operations, you can perform better customer and vendor risk assessment, implement a strong customer identification program and KYC policies, and keep everyone involved in your company safe – all which lead to better customer acquisition and retention.

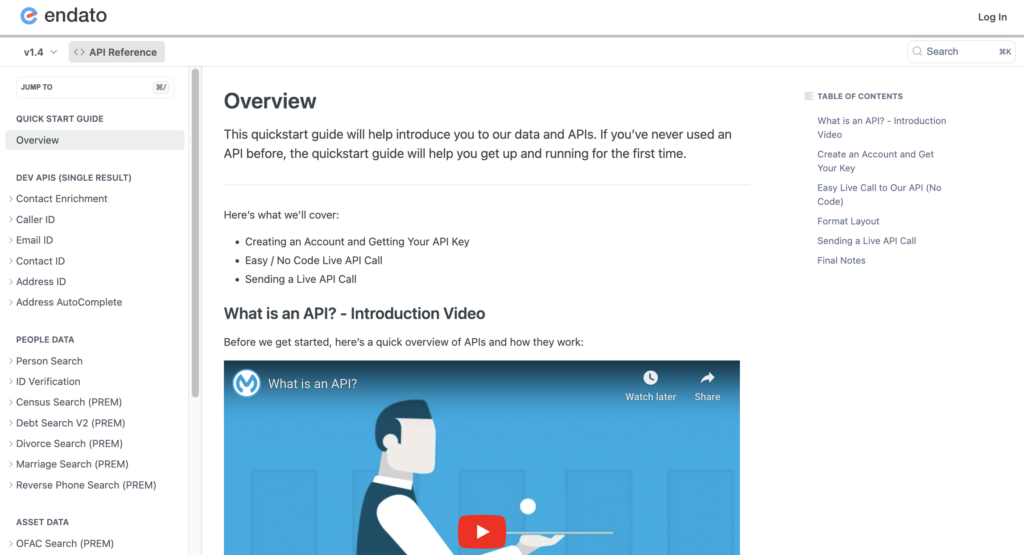

API integration with Endato offers a custom solution that streamlines your operations and boosts your workflow efficiency. Whether you need to verify the identity of individuals, perform ongoing monitoring, or simplify your day-to-day routine, API integration can save you time and money by eliminating the need to switch between different software or hire third-party companies. By seamlessly integrating a records database into your own software, you gain 24/7 access to a wealth of information, enabling you to keep all your data collection in-house. Try Endato today and experience the benefits of API integration for yourself.

Getting familiar with how to use Endato’s search and API products is very helpful in deciding what products you’ll want to use. We’ve created this quick start guide to walk new users through how to use Endato. Happy searching!